Discovering the new intuiz+

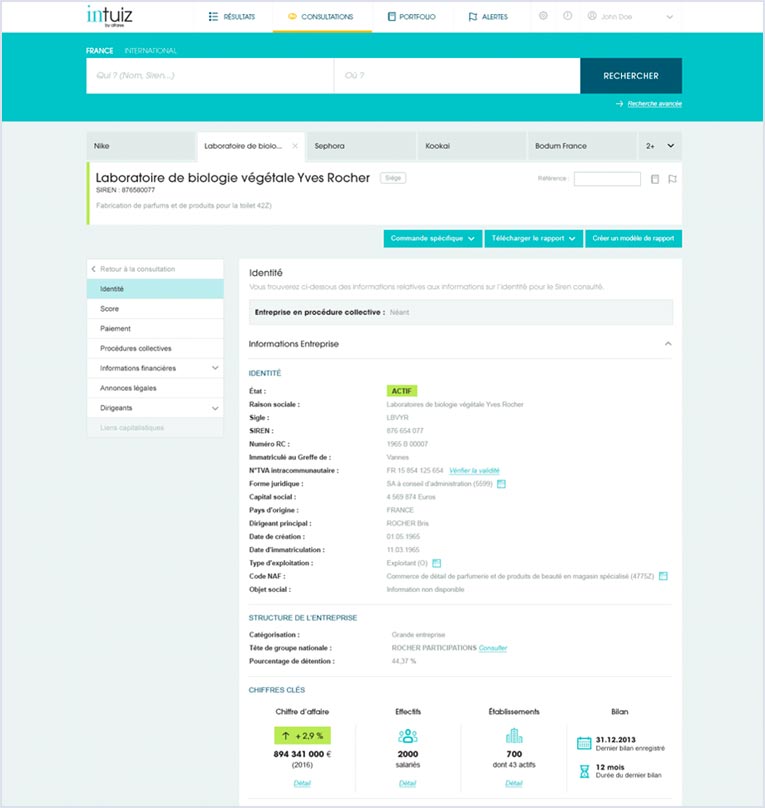

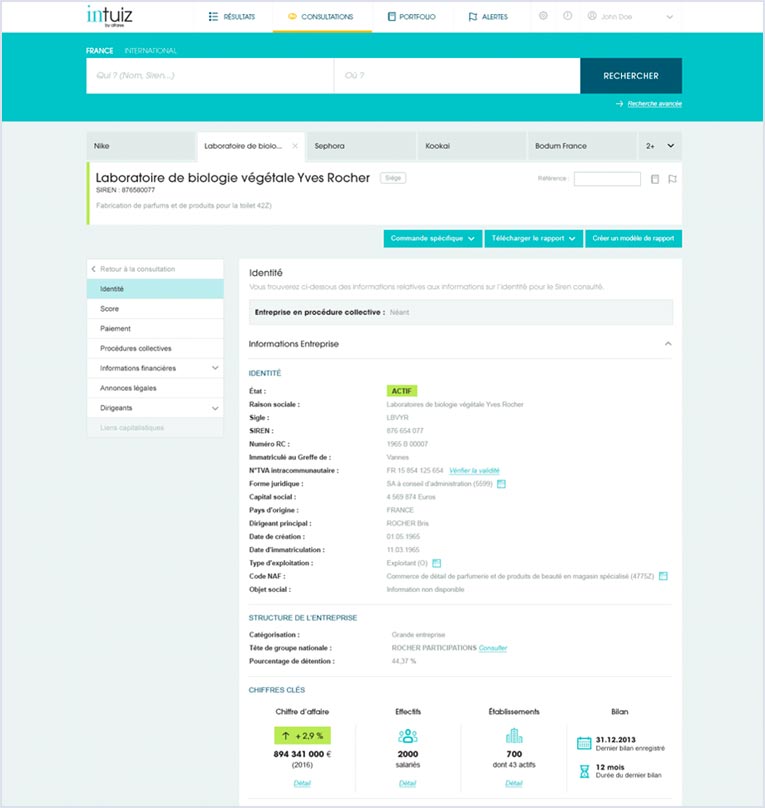

- Every detail on more than 22 million French companies.

- Verifying the legal existence of your business partner (customer, supplier, reseller, etc.)

- Collecting identity, financial and legal information

- Assessing risk (using the Altares failure score) and Paydex score (payment delay)

- Knowing the guarantee links of partners

- Have data updated daily+ [time-stamped data].

Introduction

intuiz +

Managing risks

Discover the new features of the latest intuiz+ release

FPIs, alerting to the frequency of late payments

Altares creates Frequency Payment Index (FPI) or frequency of delay alerts, which indicate the share of suppliers paid with a significant delay (+30 days) and those with a critical delay (+90 days).

- FPI 30+: proportion of suppliers paid more than 30 days late

- FPI 90+: proportion of suppliers paid more than 90 days late

.

FPIs are complementary to PAYDEX and allow for an even finer prediction of the probability of payment incidents.Where to find the FPI in intuiz+?

FPIs are available in the “payment” widget, alongside PAYDEX.

You have a two-year history and can set alerts to easily identify an improvement or deterioration in the proportion of suppliers paid with more than 30 days and those with more than 90 days delay.

Balance sheets of non-commercial associations

Until now, only the balance sheets of registered associations (declared to the Trade Register) were available in the intuiz+ platform. As of 21 October, Altares has been enriching its database with 20,200 association balance sheets from the RNA database, the French National Register of Associations.

Collective Agreements

There are 1015 Collective Agreements (IDCC) in France.

Altares collects and improves the reliability of “Collective Agreement” data thanks to its knowledge of the successor SIRET.

2.1 million SIRETs with an IDCC entered in intuiz+.

Where to find franchise links in intuiz+?

Collective Agreements are available at no extra cost, in the “identity” widget, at the establishment level.

Improved user and group management

- Search for a user with their email

- Filter by a user’s role

- Filter by group

- Expand the tree of groups and subgroups

- Duplicate the settings of a group or subgroup

- Move a subgroup to another group

Discover the latest intuiz+ module

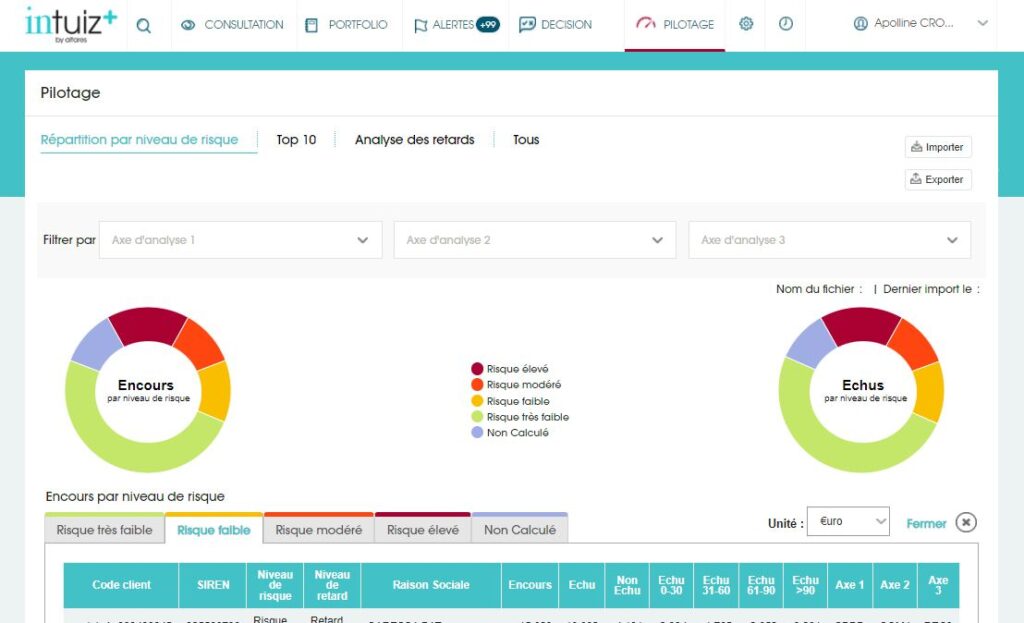

Pilotage module

Identify at a glance which third parties are most at risk and most in arrears

The intuiz+ Pilotage (steering) module helps you identify the risks related to your customer portfolio.

By cross-referencing your ageing balance data with the Altares default score and our payment behaviour index (Paydex), Pilotage delivers an enhanced view of your portfolio and allows you to identify at a glance the most at-risk and overdue third parties.

You can therefore make quick and strategic risk management decisions and prioritise your collection actions effectively.

CHALLENGES

Your challenges

Finance / Credit Management

Managing customer credit risk

- Credit risk assessment and solvency risk

- Award policy and adjustments to your payment terms

- Reducing the risk of non-payment

- Collection strategy and accelerating collections

Procurement

Managing supplier risk

- Assessing supplier risk

- Avoid supply chain disruptions

- Sourcing new French suppliers

Business Development

- Prospect intelligence and building client portfolios

- Onboarding: starting a relationship

- Validation of outstanding amounts

- Competitive intelligence

Compliance

- Fraud prevention

- Identity checks

- Final Beneficiary searches

Features

intuiz+ features

A powerful search system: find what you are looking for quickly

- Fast or advanced search

- Auto-completion

- Search in France (company name, SIREN, etc.) and internationally (company name, DUNS number etc.)

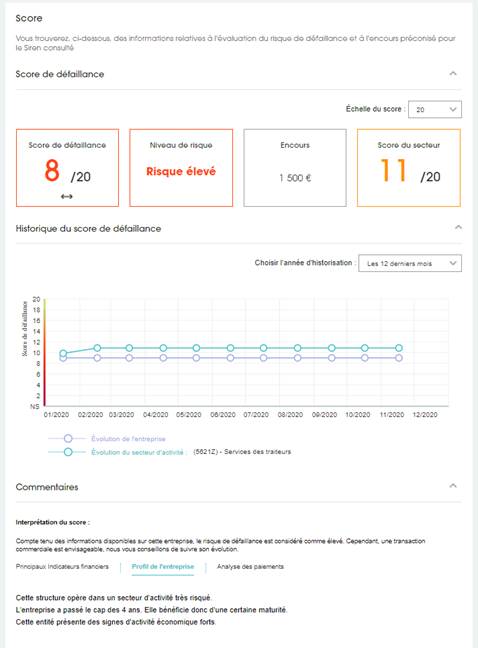

Altares default risk score

- Key indicators to help you assess the risk of default

- A history of the score over 12 or 24 months

- Comments to help you interpret the score and inform your decision

Paydex: analyse the payment habits of your third parties

- Average number of days overdue

- Advised course of action

- 12 or 24 month history

- Links to our DunTrade partnership

Consultation of company data and credit reports

- All data in one click

- Flash credit reports that are comprehensive and customised to your needs

Portfolio: keep an eye on your third parties at all times

- Keep track of your third parties by adding them to your intuiz+ Portfolio

- Easily organise your portfolio with filters

Alerts: set up an effective monitoring system

- Be informed at every key event in the life of the companies you monitor

- Customise how you receive alerts

- Filter your alerts by type of event, date, identity, to get the key information

Place your orders directly from your interface

- Ordering official documents in paper or digital format

- Surveillance of Privileges (URSSAF, Public Treasury, complementary organisations)

intuiz+ adapts to your needs

- Customisable interface, customisable data module access

API

- intuiz+ web service: intuiz+ data directly at the heart of your information system

Comprehensive and qualitative data sources

- Diversity of collection and verification sources (Bodacc, Balo, SHAL, Insee, RNCS, JO Associations) grouped together in a modelled database

- Use of indicators exclusive to Altares: Default Risk Score and Paydex

- Data Quality Management process that ensures data control and consistency.

intuiz+ modules

Identité

Risque de défaillance

Attitude de paiement

Défaillance & survie

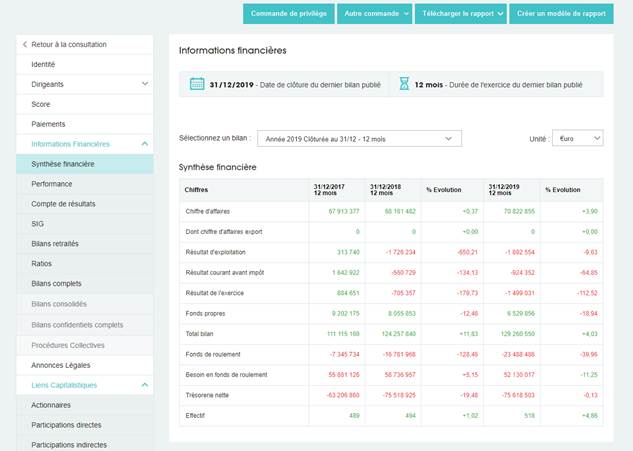

Informations financières

- Une synthèse financière pour apprécier le résultat et la trésorerie

- Un bilan retraité pour visualiser les grandes masses actif/passif

- Le compte de résultat pour constater la valeur patrimoniale

- Les soldes intermédiaires de gestion pour apprécier la performance

- Un ensemble de ratios pour mesurer les critères de rentabilité ou de structure

- Tous les bilans complets disponibles

- La possibilité de commander les rapports de gestion des entreprises

Annonces légales & procédure collective

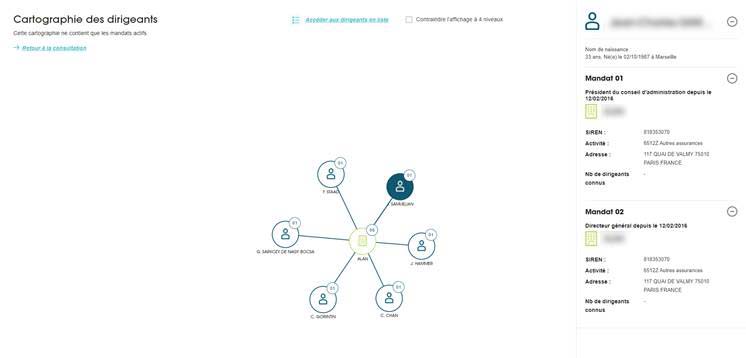

Dirigeants et décideurs

Actionnariat & participation

Mes rapports

- Rapport Flash: vous voulez connaître l’encours que vous pouvez accorder à votre client ? Vous voulez vérifier une information que vous avez entendue sur votre fournisseur ? Le prospect ciblé est-il vraiment fiable ? Le rapport flash, véritable outil d’aide à la décision, vous permet de connaître d’un seul coup d’œil les éléments identitaires et financiers de votre partenaire. Les artisans, les SARL, les professions libérales mais aussi les sociétés anonymes, toutes les formes juridiques sont disponibles en rapport flash. La base de 9 millions d’entreprises actives en France est mise à jour quotidiennement via des sources officielles et corrigée par des équipes expertes.

- Rapport complet: vous avez besoin de fonds pour développer votre activité et vous devez présenter un rapport complet de votre entreprise à votre banque ? Vous souhaitez participer à une opération financière de prise de parts sociales et vous voulez connaître en détail l’entreprise et son historique ? Vous souhaitez vous associer avec un partenaire, mais est-il fiable ? Y a-t-il des événements dans son historique financier ou de direction que vous avez besoin de connaître ? Le rapport complet est un véritable outil d’analyse et d’aide à la gestion d’entreprise. Il s’agit d’un audit financier professionnel et complet, similaire à ceux réalisés par les cabinets d’audit, qui prend en compte la situation actuelle mais aussi l’historique de l’entreprise. Les rapports complets sont disponibles pour toutes les entreprises quelques soient leur statut, taille ou chiffre d’affaires. Les rapports sont mis à jour quotidiennement via des sources officielles (INSEE, RCS, Greffes) et toutes les données sont agrégées par des experts Altares.

Commandes spécifiques

Analyse financière

Dirigeants et décideurs

Pilotage : Un module optionnel d'intuiz+

Bénéficiaires effectifs

You want to learn more about intuiz+?

Contact one of our risk management expert. We'll be happy to help you