More than 10 billion pieces of corporate data

Altares, a member of the global D&B network, is able to give you access to the largest BtoB database in the world

Data: expertise and people

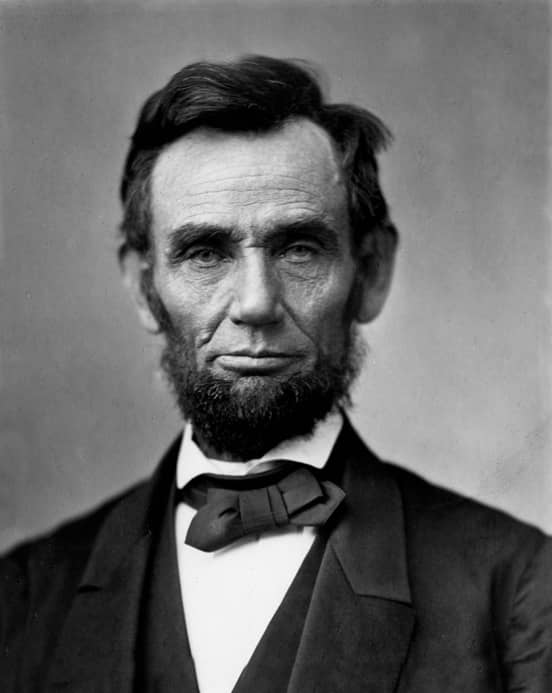

Do you recognise the man on the right? Long before he was named President of the United States, in an era when real business information was gathered on horseback and in carriages, as a credit reporter he contributed to our company’s legacy.

Today, within Altares-D&B, more than 80 data experts work in the various departments responsible for identifying sources, collecting, standardising, correcting and finally cross-referencing sources to guarantee you the most reliable and recent information.

French data

A history of 34 million businesses since 1987

12 million

ACTIVE PRIVATE AND PUBLIC COMPANIES

800000

COMPANIES WITH A PAYDEX SCORE

11.3 million

COMPANIES WITH A FAILURE SCORE

4.9 million

BENEFICIAL OWNERS

1 million

MORE THAN ONE MILLION GUARANTEE LINKS

Of the 12 million companies, 4.6 million have an actual economic activity (excluding public sector organisations)

1.3 million

BALANCE SHEETS GATHERED EVERY YEAR

1.5 million

LEGAL NOTICES HANDLED PER YEAR

1.2 million

URLs

3.5 million

EMAILS

International data

Discover Altares-D&B’s global coverage per country, by volume of businesses (active and inactive) in the data base

550m

COMPANIES

231m

240

100m

GUARANTEE LINKS

161m

BENEFICIAL OWNERS

180m

CONTACTS

28m

ENTITIES WITH PAYDEX

4.8m

CALCULATED

210m

INVOICES HANDLED/YEAR

The D-U-N-S Number

The Global Unique Business Identification Number

The DUNS Number is a unique 9-digit code for companies worldwide. Issued by Dun & Bradstreet, it is your company’s digital business card to the outside world, but also a tool for structuring your own data.

The amount of data within companies is growing exponentially. By using our data and the unique coding of the DUNS number, you get a structured view of the information in your CRM systems, ERP systems or administration software.

The patented Process, DUNSRight™ is the key differentiator and guarantees compliance with international standards.

Our demand for quality

Altares collects, aggregates, analyses, enriches and structure data to make it “smart” and facilitate agile decision-making for the general and operational management of businesses.

Decision support indicators/scores

Paydex

The exclusive international indicator on payment behaviour

The exclusive international indicator on payment behaviour Altares offers 2 key indicators, the Paydex and the FPI (Frequency Payment Index) to evaluate the payment attitude of a company or a public organization, in order to help you in your decision making when entering into a relationship or pursuing it.

Frequency Payment indicators (FPI)

Do you want to protect yourself against the accumulation of late payments?

Altares has developed the Frequency Payment Indicators (FPI), reactive alerts that signal the first payment difficulties of a company. The IPFs are composed of 2 indicators that precisely qualify the probability of late payment of a company towards its suppliers.

Survival score

Evaluate the probability that a company in safeguard or receivership will still be active in 6, 12, 24 and 36 months

After filing for bankruptcy with the court, a company in financial difficulty is subject to :

Or a judgment of safeguard or legal redress; a period of observation opens during which the company will continue its activity to try to find a positive outcome (adoption of a plan) and thus avoid the conversion into liquidation.

Either an opening of judicial liquidation or an assignment plan (partial or total).

Failure score

Anticipate failure

The Failure Score corresponds to a risk rate - the probability of entering into collective proceedings (Safeguard, receivership and judicial liquidation) over a twelve month period.

The DunTrade Program

A single objective: An objective view of the financial health of companies

The DunTrade ® program is a factual observation of the payment reality in which the members of the D&B global network participate, through a proprietary late payment collection and analysis program.

Appetence score (Sales & Marketing)

Prioritize your prospecting actions

The appetence score reflects the probability that a prospect is interested in the solutions you offer and will become a customer. It is based on the analysis of your portfolio (look alike) to determine more or less attractive profiles. It allows marketing teams to prioritize their campaign and sales people to prioritize their canvassing.

And what are your challenges on the customer side?

Collecting and investigating

Our data collection covers corporate identity information, qualifying information and legal data.

Legal and juridical identity, legal category – share capital, activity, formation date, registration date, number of employees, number of establishments, telephone, fax, emails, guarantee links, statutory managers, beneficial owners, operational managers, balance sheets, collective procedures, legal announcements, payment experiences, etc.

But also behavioural data or Open Data sources. For data of a personal nature, you can consult our Privacy policy

Verifying

The quality of the data in the ALTARES database is ensured by various checks and procedures:

- Cross-checking information with official sources,

- Verification by a dedicated team that official information is assigned to the right company,

- Implementation of IT business rules that reject unreliable or inconsistent submissions for specific processing,

- Continuous training of staff in charge of collecting information on legal developments and legal information channels,

- Quality audits on our suppliers,

- Proprietary process by which D&B transforms raw data into value-added information,

- Relies on Quality Assurance (+ 2000 checks).

Paydex

Paydex anticipates your customers’ chance of default. Our partners use this index to establish better collection or business development strategies and thereby enable a predictive analysis of their customers’ default risk.

Payment Performance Insights

Optimise your collection strategies, improve your credit decisions and facilitate your business development with PPI

D-U-N-S Number

The 9-digit DUNS is issued by Dun & Bradstreet. This identifier is used to create a credit file, which is often necessary for companies in the context of their commercial partnerships, particularly to help them ensure the legal and financial verification of their customers and suppliers.