DunTrade

Do you know your customers’ payment habits?

What is DunTrade®?

DunTrade is an international programme for exchanging and sharing information on the payment habits of your customers.

DunTrade collects monthly payment experience from our partners’ client accounting.

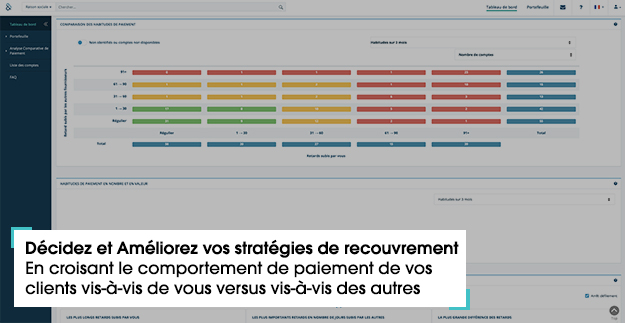

Partner companies provide information such as the aged balance (which lists all payments expected by the company, and highlights any delays in collection), and in return receives a comparative payment analysis. This analysis compares the payment attitude of your customers towards you versus others.

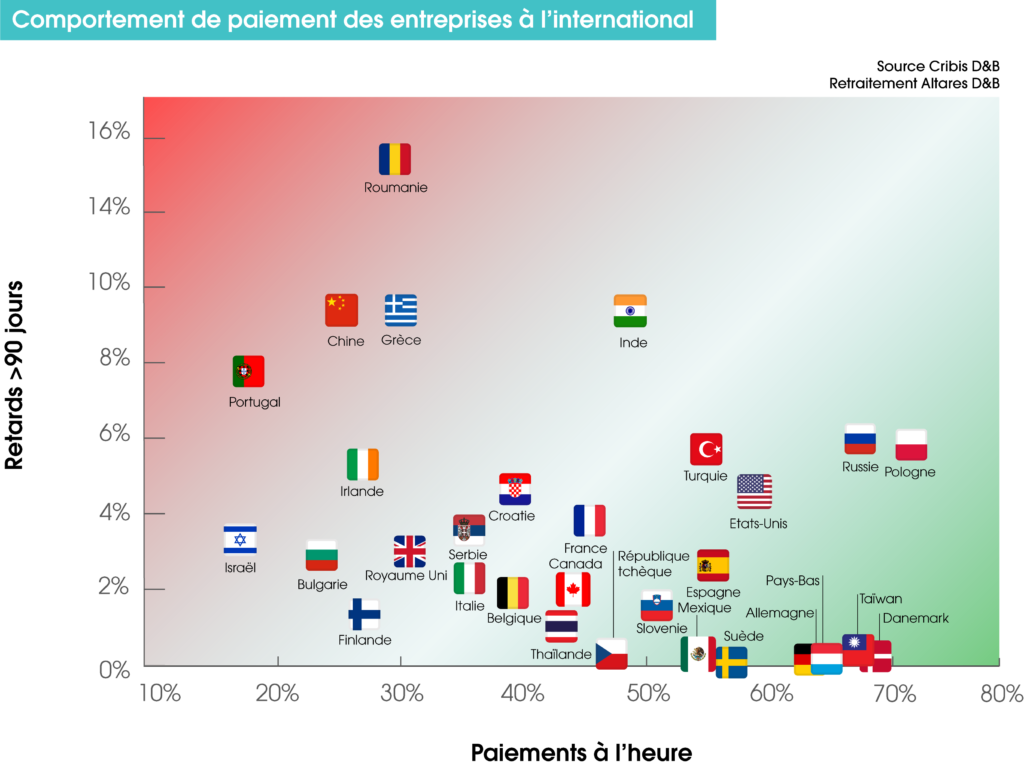

Less than a one in two chance of being paid on time

45%

WORLD

45%

EUROPE

43%

FRANCE

More than one month’s payment delay

13%

WORLD

10%

EUROPE

8%

FRANCE

What are payment habits?

Payment habits are defined as the way in which a customer pays their suppliers : in advance, on time or late. It should therefore be distinguished from non-payment.

Delayed payments are calculated as soon as the negotiated payment period has been exceeded.

It is the leading indicator of cash flow difficulties for companies: it allows us to predict VSE insolvency within 6 to 12 months, and SME and ETI insolvency within 24 months. In France, the annual amount of unpaid invoices is €56 billion*.

*FIGEC (French National Federation of Business Information, Debt collection and Civil Investigation)

What problems does the DunTrade programme solve?

CASH FLOW

Payment terms. Debt collection strategies.

RESULTS

Reduces losses. Provisions for doubtful debts.

PRODUCTIVITY

Automates decision making. Debt collection strategies.

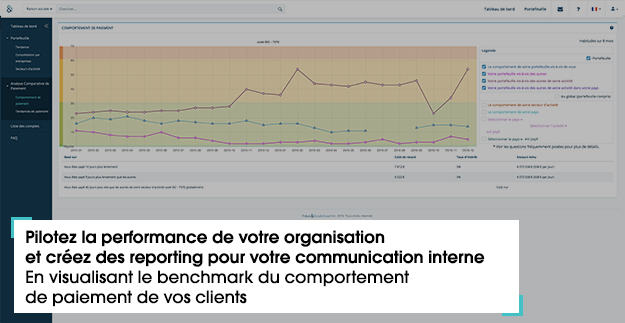

REPORTING

Benchmarking and steering for internal departments and/or groups.

TURNOVER

Increases outstandings and improves data visibility and responsiveness.

How does DunTrade work?

The DunTrade programme was created in 1968 in the United States and in 1984 in Europe by Dun & Bradstreet, the world’s leading provider of payment data. D&B has 50 offices worldwide, each collecting payment experiences from companies in over 170 countries.

Dun & Bradstreet collects 2 billion transactions from 15,000 global partners , compiling a total of 16 million Paydex scores worldwide.

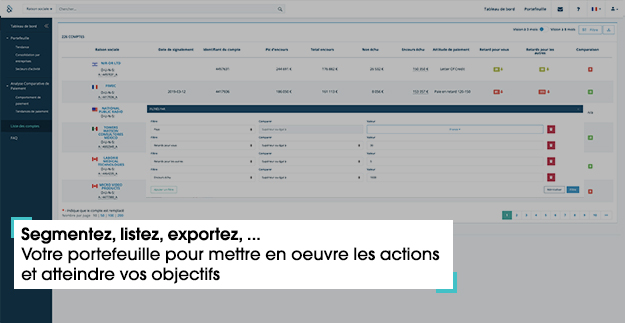

The DunTrade programme collects and analyses partners’ ageing balances to identify late payments and facilitate payment performance analysis. This information will help you make decisions about granting credit or your debt collection strategy..

The DunTrade programme manages data exchanges: programme participants agree to share their accounts receivable data, enabling us to calculate a payment experience score. In return for the data they provide, our partners have access to their payment comparison analysis using our PPI (Payment Performance Insights) application.

Naturally, DunTrade partnerships are governed by non-disclosure rules, guaranteeing that your data remains strictly confidential and that the General Data Protection Regulation (GDPR) is followed.

How can DunTrade help you?

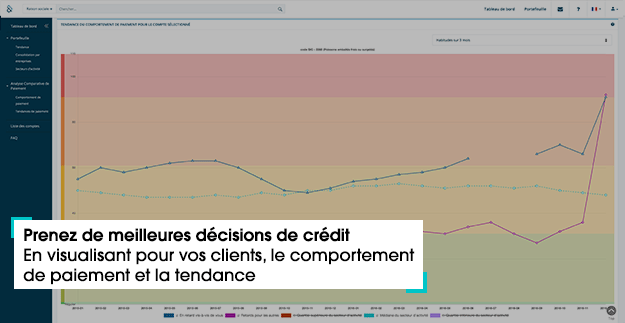

With DunTrade, you get a comparative payment analysis: you can identify if a company has better payment behaviour with other suppliers than with you . You can thereby identify the cash flow you could free up if that company improved its payment habits with you.

Thanks to the DunTrade payment habits programme, your being able to anticipate risk therefore enables you to direct your business activity in the best possible way (avoid doing business with bad payers) and implement an appropriate collection strategy (amicable or contentious).

Paydex and predicting corporate insolvency

Altares – D&B’s partner in France, Benelux and North Africa – uses DunTrade to enhance its scores and publish its payment performance analysis. Paydex, DunTrade’s payment score, is also used to calculate other scores, including the Failure Score, which customers can use in their decision-making processes.

Analysing these payment habits can help you assess a company’s default risk (customers or prospects). Indeed, 25% of corporate insolvencies* in France are the result of late payment or default.

*Altares figures

The Payment Performance Insight (PPI) solution

PPI is a comparative payment analysis platform .

Payment Performance Insight (PPI) offers a highly intuitive web interface, providing an analytical view of your receivables. Analysing payment habits will help you define your debt collection strategy, make credit decisions and ’steer business decisions’ effectively. PPI provides you with essential reporting and benchmarking information to manage your business.

The analysis can be displayed different ways within the PPI interface, or as files for integration into your systems.