Finance Analytics:

La santé financière des entreprises dans le monde entier en quelques clics

Avec D&B Finance Analytics, vous construisez une relation de confiance avec vos clients, fournisseurs et partenaires, quels que soient le continent et le pays, pour assurer un développement pérenne de votre entreprise. .

- Identifiez de manière sûre votre tiers, clients ou fournisseurs, quels que soient le pays et le continent

- Facilitez vos décisions sur vos tiers avec un accès rapide aux informations de qualité et harmonisées grâce au processus Dunsright de Dun & Bradstreet

- Retrouvez à coup sûr vos tiers grâce aux données préliminaires

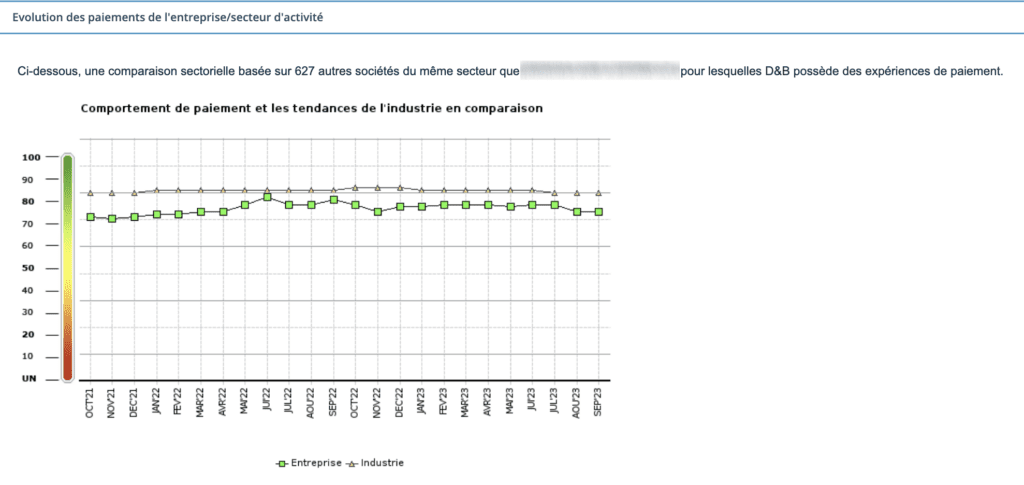

- Suivez les tendances positives ou négatives de la santé financières de vos clients et fournisseurs

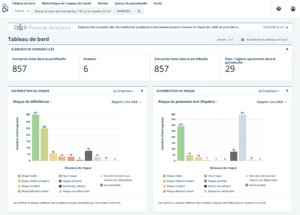

- Pilotez votre portefeuille, grâce à des tableaux de bord paramétrables

« * » indique les champs nécessaires

CHIFFRES CLES

240

Pays couverts

550m

d'entreprises

120m

liens capitalistes

375m

de maj hebdomadaires

30.000

Sources d'informations

Finance Analytics vous donne accès aux informations sur la santé financière des entreprises dans le monde

Découvrez Finance Analytics, une solution de gestion du crédit facile à utiliser qui optimise les processus financiers. Elle combine les données clients au Data Cloud de Dun & Bradstreet pour attribuer et maintenir les bonnes lignes de crédit. Elle standardise l’évaluation du crédit, effectue des analyses avancées du portefeuille et des comptes, réduit efficacement le DSO, et offre un accès instantané aux scores de crédit commercial, à l’analyse prédictive et à des données mondiales fiables. Cette solution fournit des informations basées sur le numéro D-U-N-S® de Dun & Bradstreet pour des évaluations de risque complètes à l’échelle mondiale, disponibles dans plus de 220 marchés, incluant des arbres capitalistiques d’entreprises mondiales et des Country Insight Reports de D&B pour une analyse détaillée des risques et opportunités sur un marché donné.

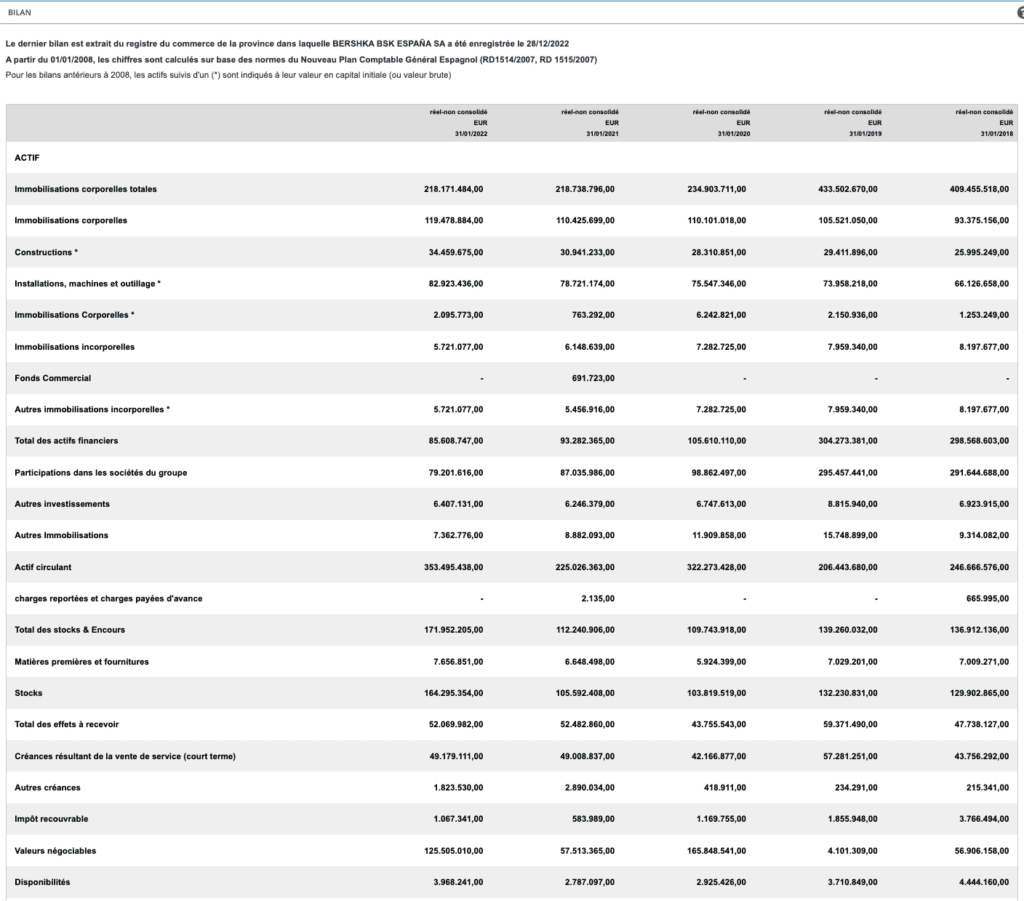

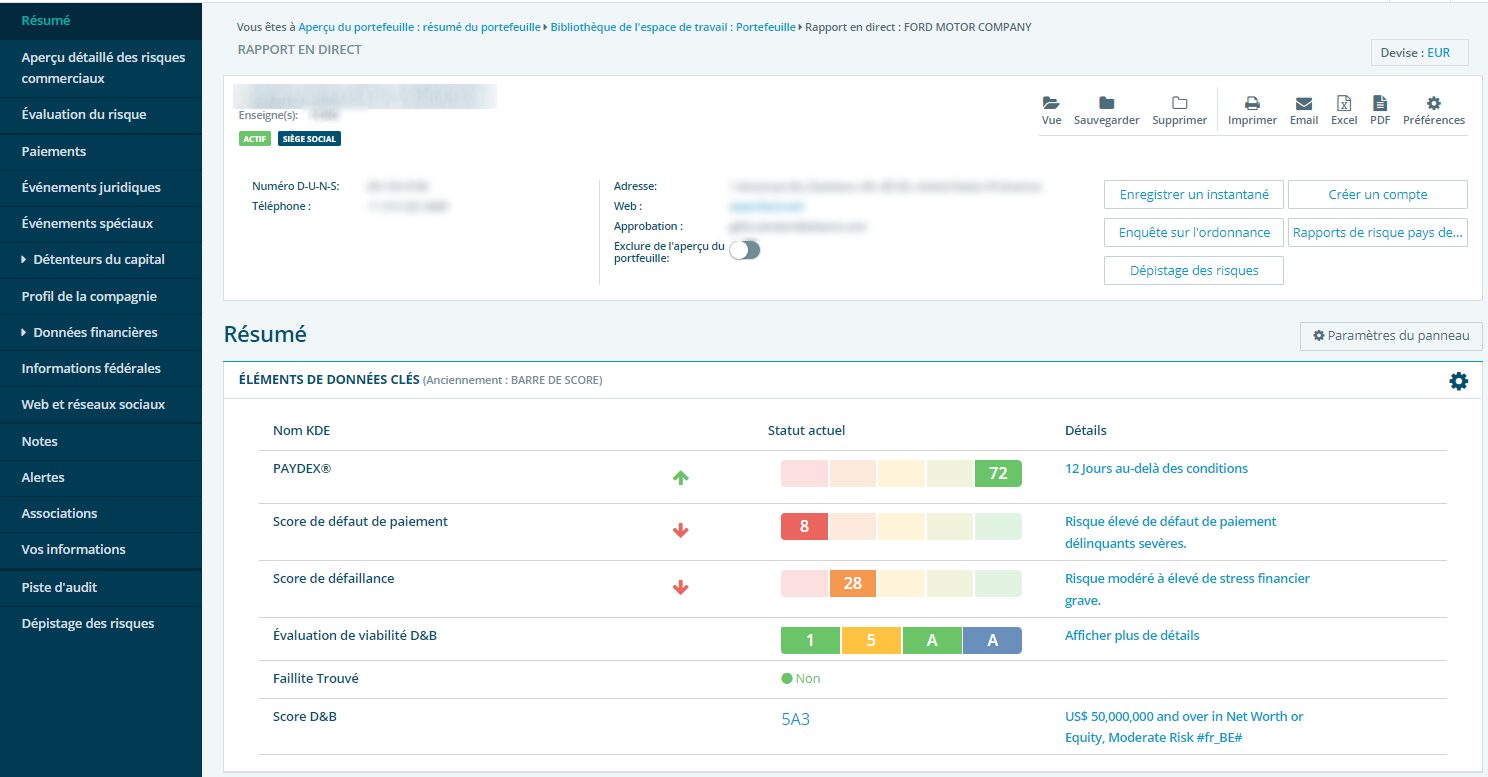

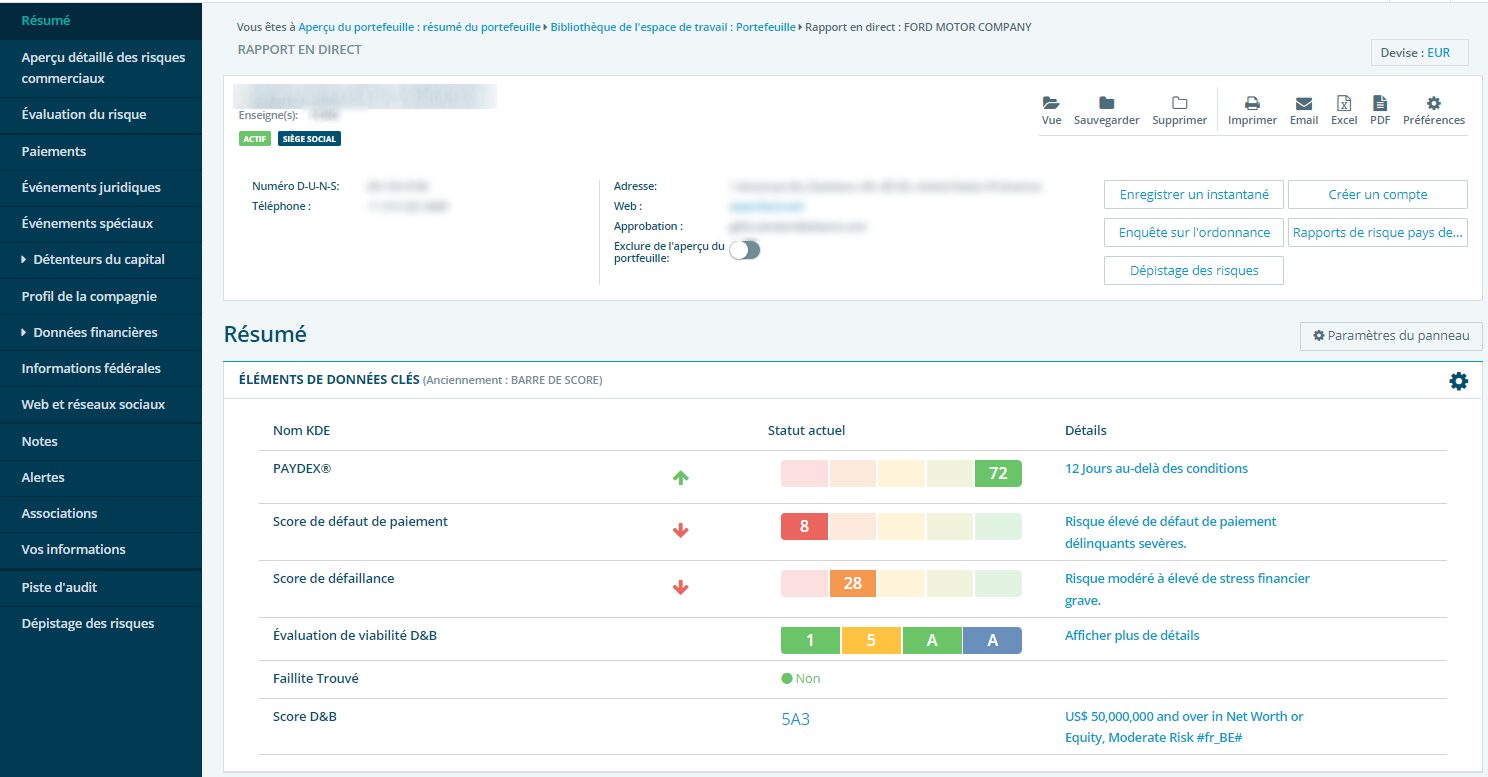

Consultez les informations clés sur la santé financière d’une entreprise

Le vaste réseau international de partenaires de Dun & Bradstreet nous permet de maintenir à jour des informations commerciales fiables sur 500 millions d’enregistrements commerciaux dans le monde entier, environ 375 millions de données mises à jour de façon hebdomadaire. Les données captées concernent des informations identitaires, financières, comportementales, légales et fournissent également des indicateurs d’analyse et des aides à la décision.

Vous avez accès à :

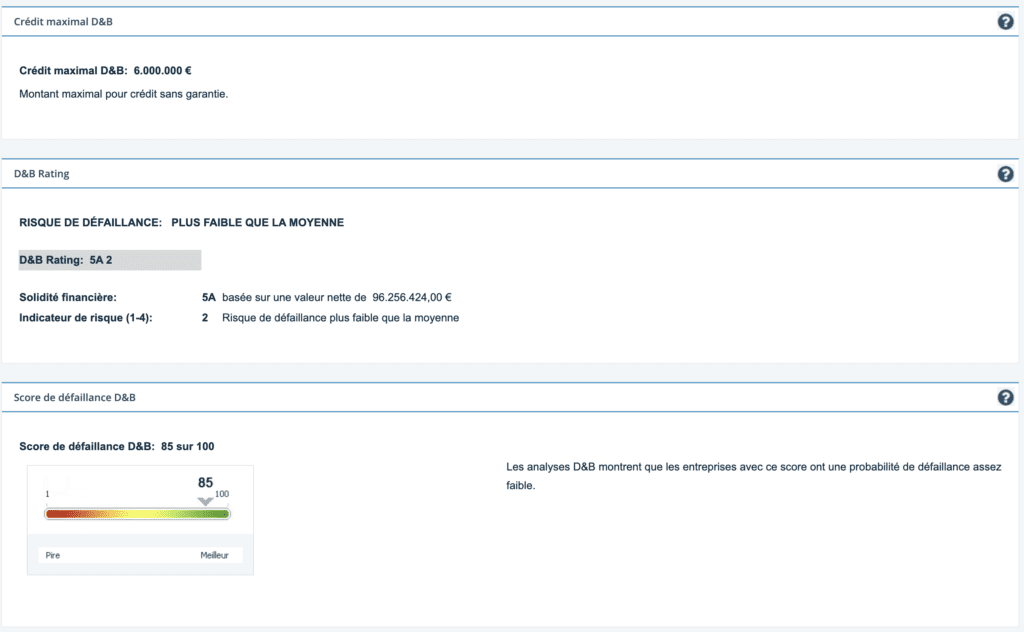

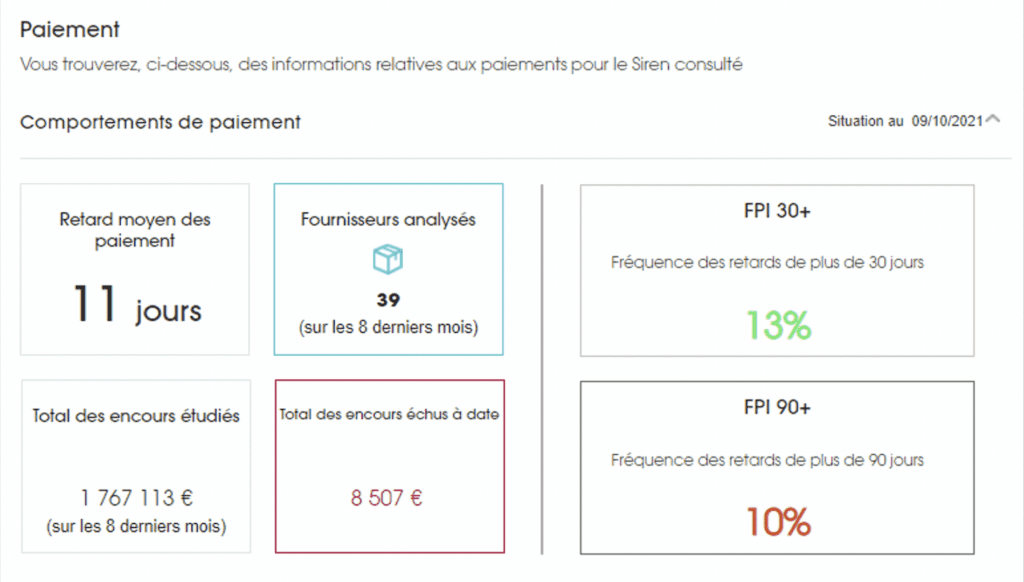

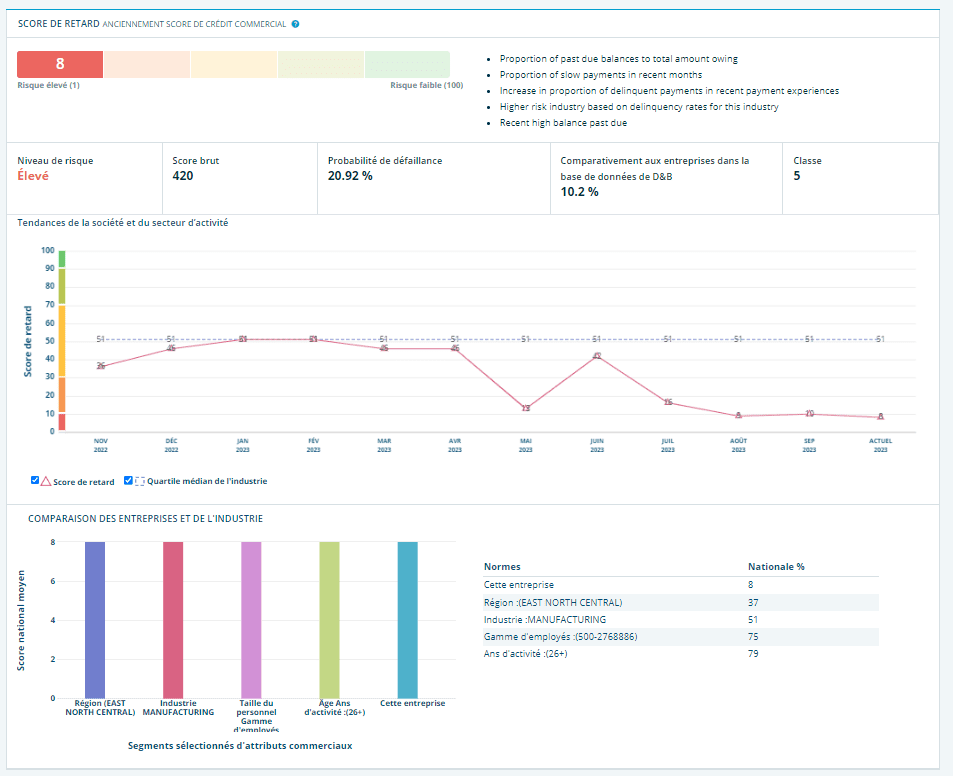

Des indicateurs essentiels pour la bonne continuité de vos affaires

Les indicateurs proposés sont destinés à mesurer le risque de défaillance d’une entreprise, ainsi que la valeur de l’encours que vous pourriez lui accorder, en se basant sur les ressources Data et Data Science des différents correspondants dans chaque pays. Accédez à des scores et indicateurs essentiels tels que D&B Rating, Crédit Maximal et Score de Défaillance.

Fonctionnalités

Recherche facilitée

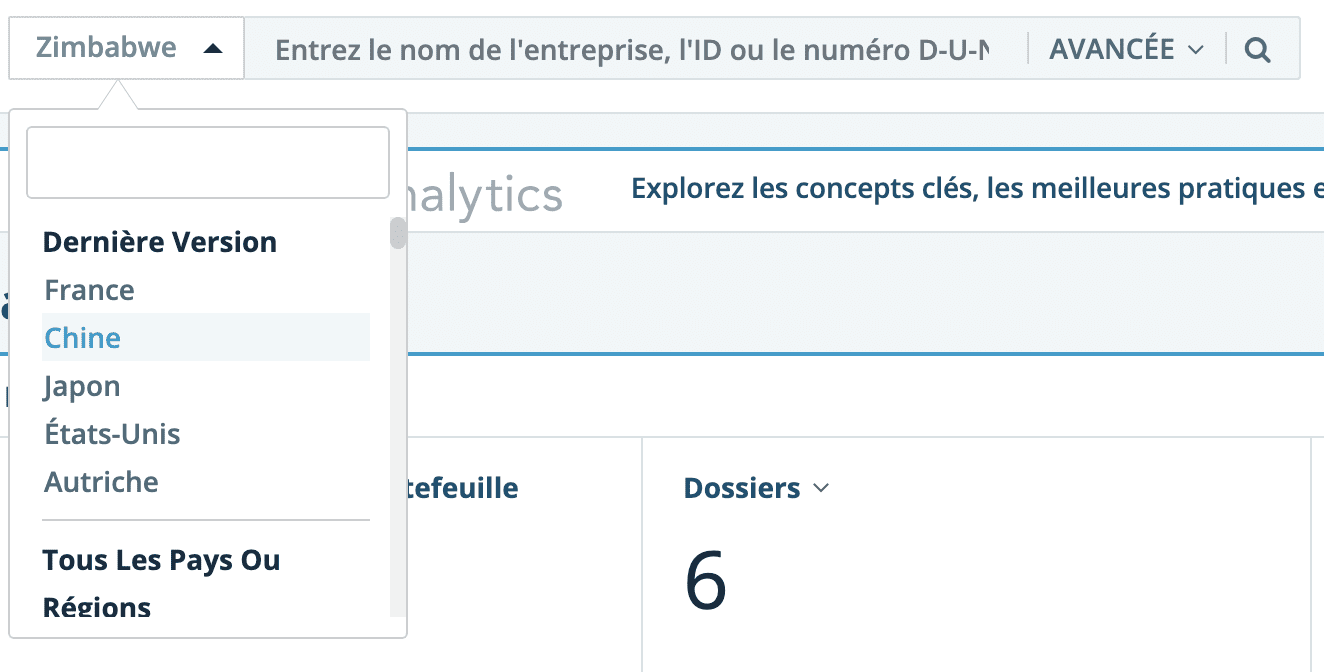

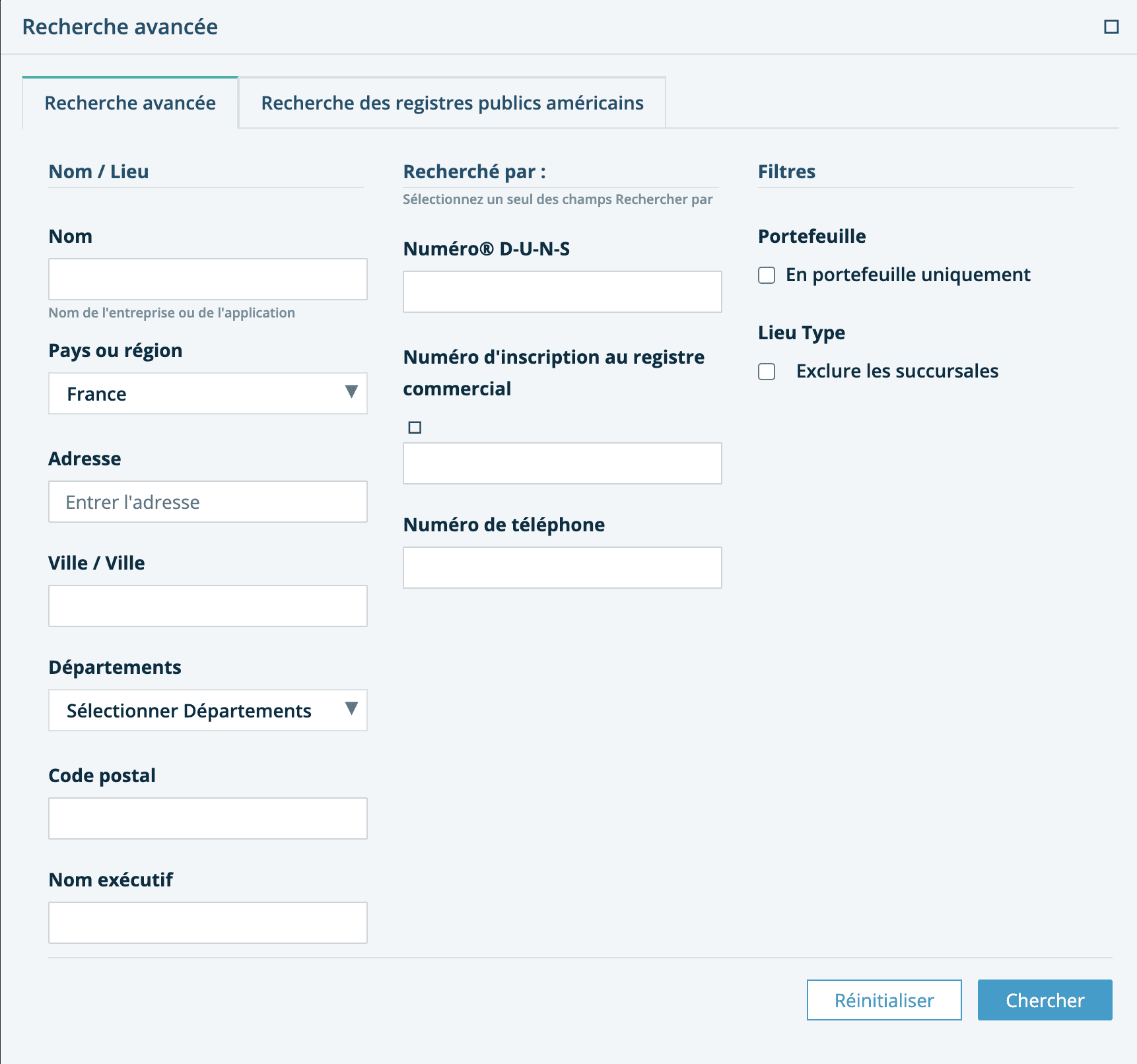

Trouvez aisément et rapidement une entreprise dans le monde entier

Identifiez une entreprise dans le monde peut s’avérer complexe pour des questions de langues et d’usages. Les capacités de recherche, adossées à la base monde Dun & Bradstreet de plus de 500 millions d’entités vous donnent les meilleures chances de trouver une entreprise, quel que soit le pays concerné.

Recherche simple

Recherche avancée

Les notices d’alerte

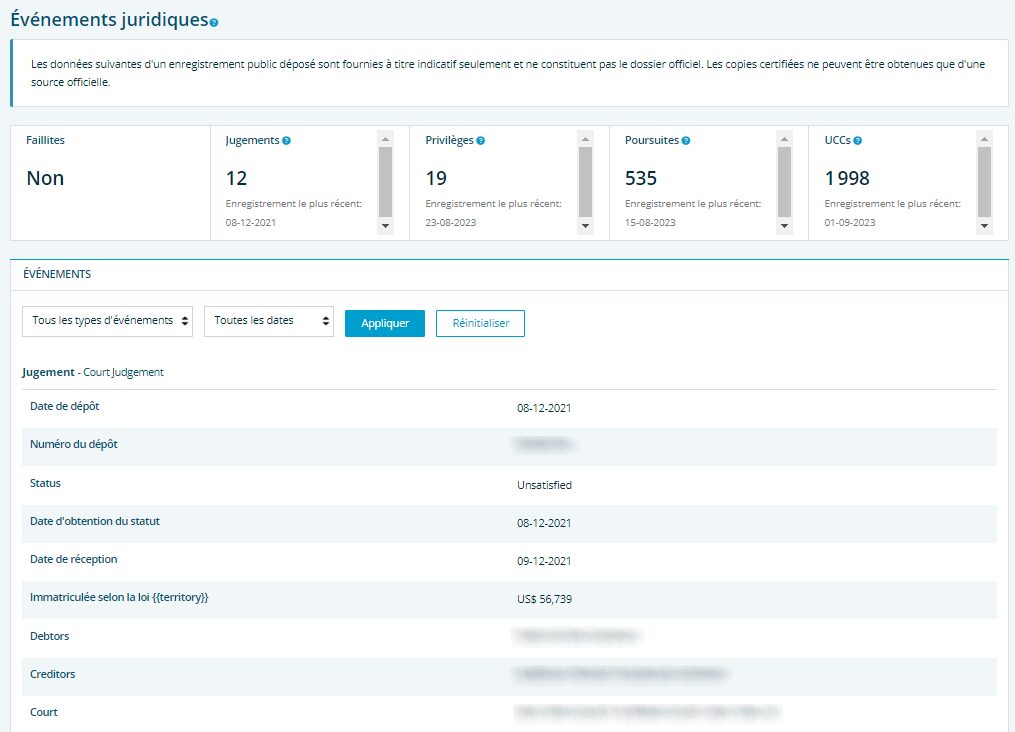

Ajustez vos décisions dès qu’un changement intervient pour l’un de vos tiers tel que :

- l’entrée ou le suivi des procédures collectives,

- le changement du score de défaillance

- le changement du comportement de paiement (retards, incidents, privilèges),

- l’évolution de l’actionnariat, des dirigeants,

- les changements d’adresse,

- les événements légaux (ex : augmentation de capital).

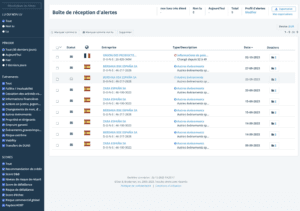

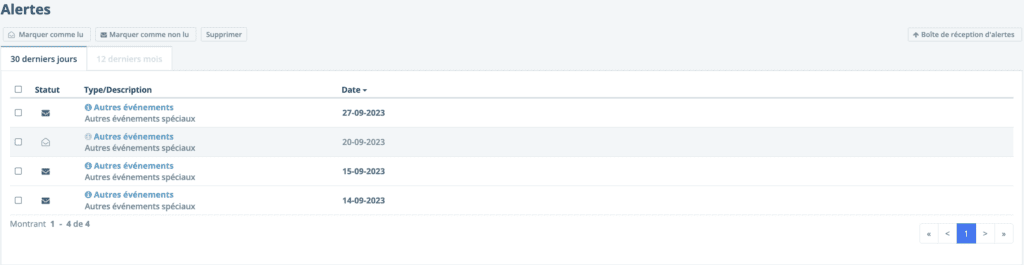

Avec l’éloignement et les frontières, il pourrait être difficile de suivre les évolutions et les changements de vos clients ou fournisseurs. Grâce à la présence dans le monde entier du réseau Dun & Bradstreet, Altares- D&B vous informe par email et/ou sur D&B Finance Analytics dès qu’un évènement intervient, pour vous permettre de réagir dans les meilleurs délais.

La fonctionnalité Profil d’Alerte vous permet de paramétrer le mode d’envoi des alertes (par email ou en consultation) les personnes au sein de votre organisation ou non qui reçoivent les notices, et de différencier le paramétrage en fonction de la segmentation de votre portefeuille.

Dans des organisations complexes et/ou avec des volumétries clients/fournisseurs conséquentes, il est stratégique de gérer correctement les flux d’informations. Le paramétrage (Profil d’alerte) vous permet de prioriser vos tâches et de, faciliter la transmission des informations à vos équipes. L’onglet “Alertes” vous permet de revenir sur l’historique des suivis et, d’isoler les alertes non traitées. La rubrique ”alertes” sur le rapport d’information vous permet de visualiser les alertes reçues sur une de vos entreprises mises en suivi.

Vous visualisez directement et efficacement vos données utiles, en utilisant les résumés ou les rubriques des données en détail

La lisibilité de l’information est un des critères qualitatifs importants pour :

- faciliter la bonne compréhension de la santé financière,

- accélérer les prises de décision,

- approfondir l’analyse.

Grâce au fonctionnement en rubriques, le paramétrage de l’impression et les fonctionnalités d’exportation, et même le panneau de présentation du rapport d’information.

La gestion de votre portefeuille

Vous pilotez l’ensemble de votre risque clients et fournisseurs, dans le monde entier, d’un simple coup d’œil, en organisant et paramétrant le portefeuille des consultations et en créant les tableaux de bord les plus pertinents.

Conservez une vue complète de vos clients, fournisseurs et partenaires, avec une mise à jour des principaux indicateurs.

Reconsultez directement les entreprises choisies.

Exportez tout ou partie de votre portefeuille sur Excel.

Créez et donnez les droits sur des segments (dossiers) de votre portefeuille, en fonction de votre structure et fonctionnement.

Recherche facilitée

Trouvez aisément et rapidement une entreprise dans le monde entier

Identifiez une entreprise dans le monde peut s’avérer complexe pour des questions de langues et d’usages. Les capacités de recherche, adossées à la base monde Dun & Bradstreet de plus de 500 millions d’entités vous donnent les meilleures chances de trouver une entreprise, quel que soit le pays concerné.

Recherche simple

Recherche avancée

Les notices d’alerte

Ajustez vos décisions dès qu’un changement intervient pour l’un de vos tiers tel que :

- l’entrée ou le suivi des procédures collectives,

- le changement du score de défaillance

- le changement du comportement de paiement (retards, incidents, privilèges),

- l’évolution de l’actionnariat, des dirigeants,

- les changements d’adresse,

- les événements légaux (ex : augmentation de capital).

Avec l’éloignement et les frontières, il pourrait être difficile de suivre les évolutions et les changements de vos clients ou fournisseurs. Grâce à la présence dans le monde entier du réseau Dun & Bradstreet, Altares- D&B vous informe par email et/ou sur D&B Finance Analytics dès qu’un évènement intervient, pour vous permettre de réagir dans les meilleurs délais.

La fonctionnalité Profil d’Alerte vous permet de paramétrer le mode d’envoi des alertes (par email ou en consultation) les personnes au sein de votre organisation ou non qui reçoivent les notices, et de différencier le paramétrage en fonction de la segmentation de votre portefeuille.

Dans des organisations complexes et/ou avec des volumétries clients/fournisseurs conséquentes, il est stratégique de gérer correctement les flux d’informations. Le paramétrage (Profil d’alerte) vous permet de prioriser vos tâches et de, faciliter la transmission des informations à vos équipes. L’onglet “Alertes” vous permet de revenir sur l’historique des suivis et, d’isoler les alertes non traitées. La rubrique ”alertes” sur le rapport d’information vous permet de visualiser les alertes reçues sur une de vos entreprises mises en suivi.

Vous visualisez directement et efficacement vos données utiles, en utilisant les résumés ou les rubriques des données en détail

La lisibilité de l’information est un des critères qualitatifs importants pour :

- faciliter la bonne compréhension de la santé financière,

- accélérer les prises de décision,

- approfondir l’analyse.

Grâce au fonctionnement en rubriques, le paramétrage de l’impression et les fonctionnalités d’exportation, et même le panneau de présentation du rapport d’information.

La gestion de votre portefeuille

Vous pilotez l’ensemble de votre risque clients et fournisseurs, dans le monde entier, d’un simple coup d’œil, en organisant et paramétrant le portefeuille des consultations et en créant les tableaux de bord les plus pertinents.

Conservez une vue complète de vos clients, fournisseurs et partenaires, avec une mise à jour des principaux indicateurs.

Reconsultez directement les entreprises choisies.

Exportez tout ou partie de votre portefeuille sur Excel.

Créez et donnez les droits sur des segments (dossiers) de votre portefeuille, en fonction de votre structure et fonctionnement.

Prenez contact avec un expert