DunTrade

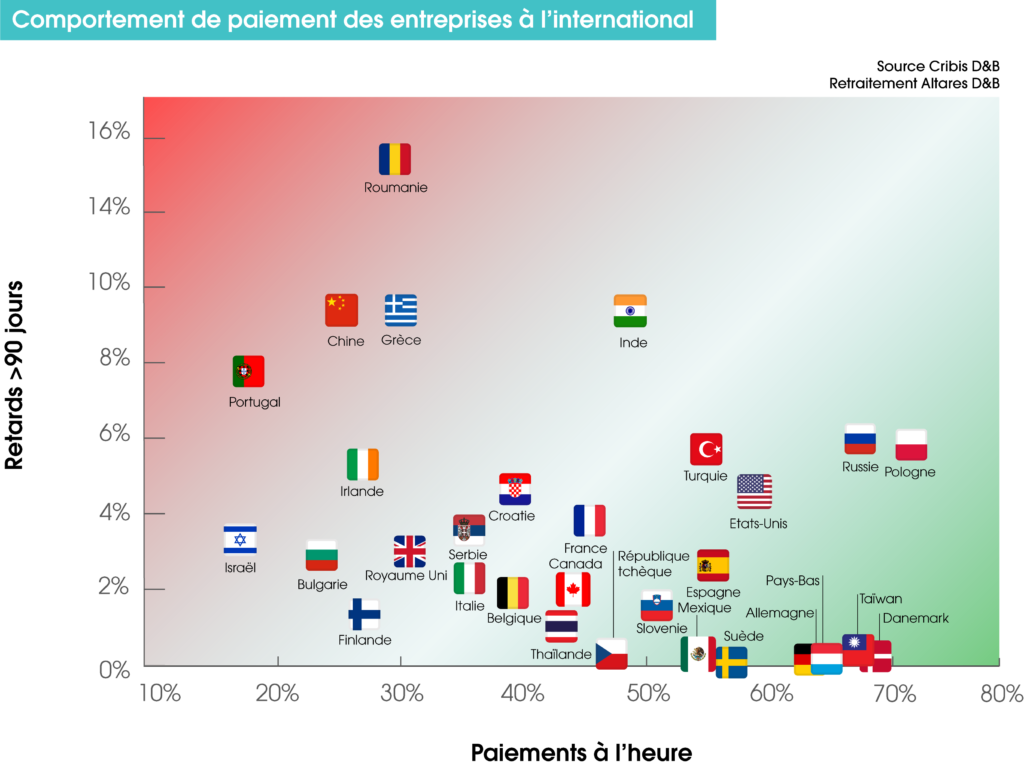

Connaissez-vous le comportement de paiement de vos partenaires d’affaires ?

Qu’est-ce que DunTrade® ?

Moins d’une chance sur 2 d’être payé à l’heure

45%

MONDE

45%

EUROPE

43%

FRANCE

Plus d’un mois de retard de paiement

13%

MONDE

10%

EUROPE

8%

FRANCE

Qu’est-ce que le comportement de paiement ?

Le retard de paiement se calcule dès le dépassement du délai négocié de paiement .

Il est le premier indicateur de difficultés de trésorerie des entreprises: il permet de prévoir la défaillance des TPE à 6 – 12 mois, et celle des PME et ETI à 24 mois. En France, le montant des impayés annuels s’élève à 56 milliards d’euros*.

*chiffre FIGEC

A quels enjeux le programme DunTrade répond-il ?

TRÉSORERIE

Conditions de paiement. Stratégies de recouvrement.

RÉSULTATS

Diminution des pertes. Provisions pour clients douteux.

PRODUCTIVITÉ

Automatisation des décisions. Stratégies de recouvrement.

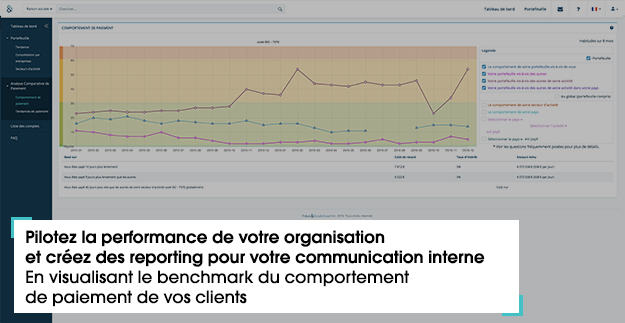

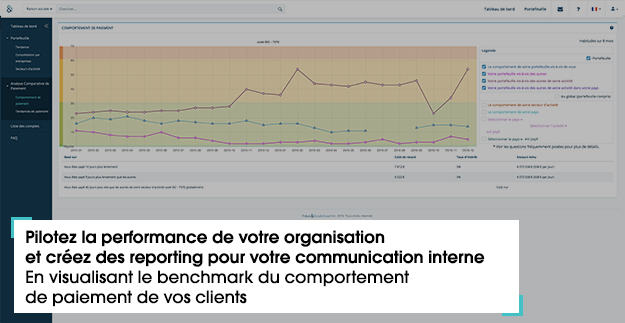

REPORTING

Benchmark et pilotage à destination des services internes et/ou groupes.

CHIFFRE D’AFFAIRES

Augmentation des encours pour plus de visibilité et de réactivité des données.

Comment fonctionne DunTrade ?

Quelle aide DunTrade peut-il vous apporter ?

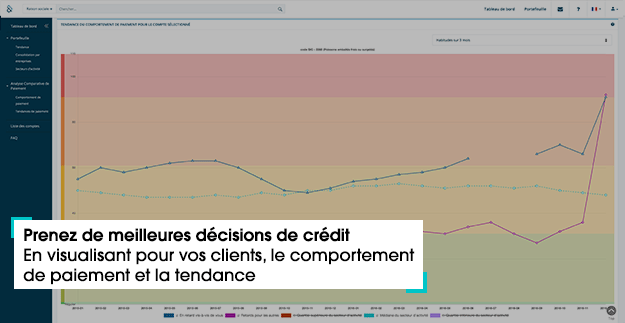

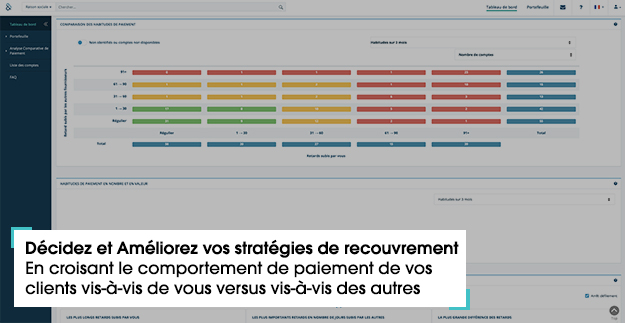

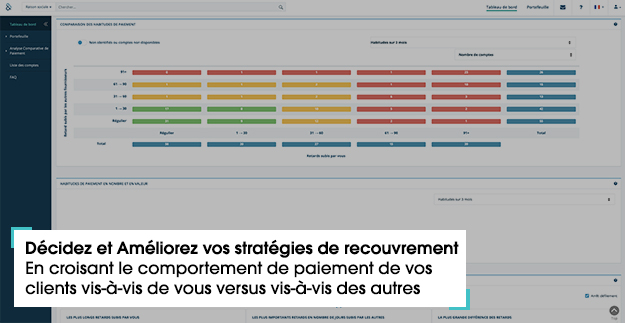

Grâce à DunTrade, vous obtenez une analyse comparative de paiement : vous pouvez identifier si une entreprise adopte un meilleur comportement de paiement avec d’autres fournisseurs qu’avec vous . Vous pouvez ainsi identifier la trésorerie que vous pourriez dégager si cette entreprise améliorait son comportement de paiement auprès de vous.

Grâce au programme de comportement de paiement DunTrade , votre anticipation du risque vous permet donc d’orienter au mieux votre activité commerciale (éviter de faire des affaires avec de mauvais payeurs) et de mettre en œuvre une stratégie de recouvrement (amiable ou contentieux) adéquate.

Paydex et prédiction de défaillance d’entreprise

L’analyse de ces comportements de paiement permet d’évaluer le risque de défaillance d’une société (client ou prospect). En effet, 25% des défaillances d’entreprises* françaises sont la conséquence de retards ou de défauts de paiement.

*chiffre Altares

La solution PPI (Payment Performance Insight)

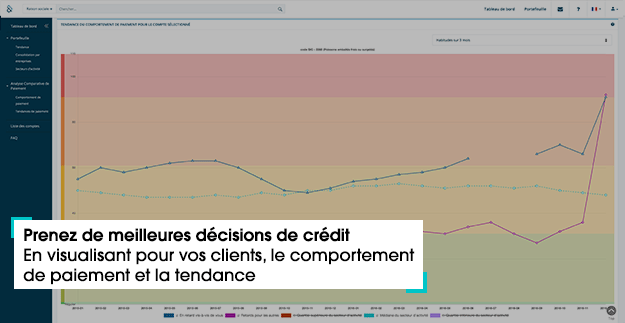

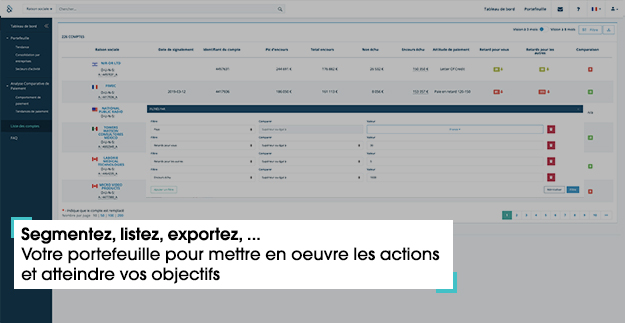

La solution de la performance de paiement – PPI – propose une interface web très opérationnelle, fournissant une vision analytique de votre poste clients. L’analyse des comportements de paiement répond à des enjeux de stratégie de recouvrement, de décisions de crédit et d’ orientation commerciale . PPI vous fournit les éléments de reporting et de benchmark essentiels dans votre pilotage.

L’analyse peut être restituée sous différents formats au sein de l’interface PPI, ou sous la forme de fichiers à intégrer dans vos systèmes.

Et vous, quels sont vos enjeux sur le poste client ?

Nos data

Paydex

Payment Performance Insights

D-U-N-S Number

Le DUNS, composé de 9 chiffres est délivré par Dun & Bradstreet. Cet identifiant permet de créer un dossier de crédit, souvent nécessaire aux entreprises, dans le cadre de leurs partenariats commerciaux, notamment pour assurer les vérifications légales et financières de leurs clients et fournisseurs.